Bullish and Bearish Flow / Most Active Calls and Puts

Top Calls / Top Puts

Bullish Flow / Bearish Flow

Shows those stocks with the top net dollar flow in options.

- Bullish Flow: Calls traded on the Ask and Puts traded on the Bid (written or closed)

- Bearish Flow: Calls traded on the Bid (written or closed) and Puts traded on the Ask

- Count: number of alerts that traded on the Bid/Ask and were included in the net dollar flow amount

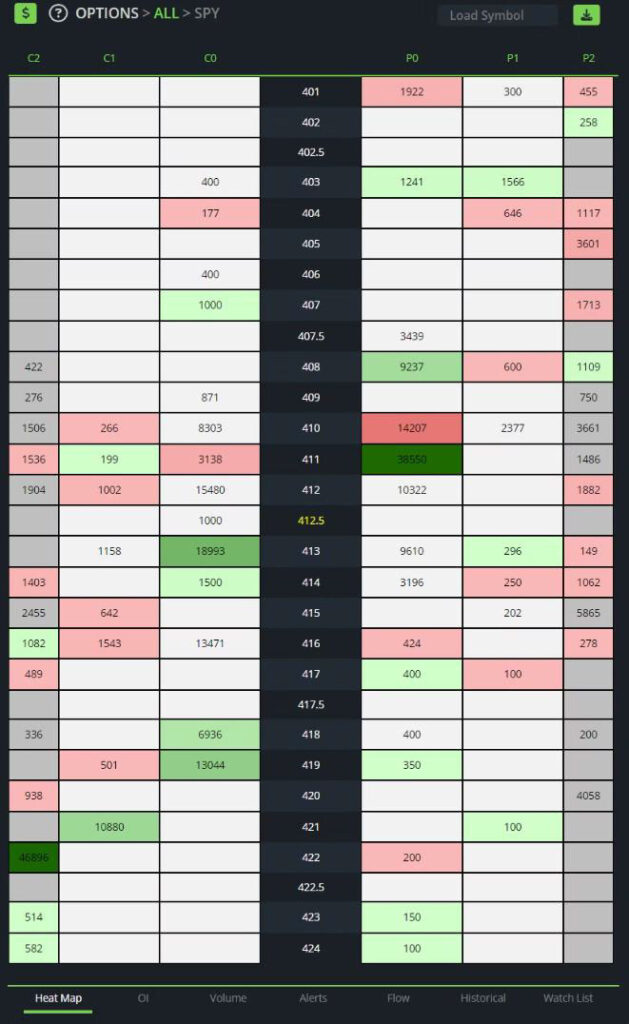

Options Heat Map

Heat Map

The Heat Map is a representation of the day’s options flow. The Heat Map shows the frequency of flow centered around the contract strike price nearest the current price in yellow. Calls (C) are on the left and puts (P) are on the right.

- C0 and P0 columns include all contracts expiring in the current week

- C1 and P1 columns include all contracts expiring the following week

- C2 and P2 columns include all contracts expiring in 2 weeks or more

- Green shading indicates Bullish Flow (Calls traded on the Ask and Puts traded on the Bid). Cells with the darkest shading indicate areas of the highest trade activity

- Red shading indicates Bearish Flow (Calls traded on the Bid and Puts traded on the Ask)

Options Alerts

Alert Types

Rapid Fire Alert: This alert triggers when multiple trades in a call contract with the same price and expiration occur within a 2 minute window.

Repeater Alert (Bullish or Bearish): This alert triggers when multiple trades in a contract with the same price and expiration occur within an allotted time frame.

Roulette Alert (Bullish or Bearish): This alert triggers when the opening transaction exceeds open interest with bullish call sweeps or bearish put sweeps at or above the ask, in options expiring in the current week. Please note these contracts are HIGHLY SPECULATIVE, highly volatile, and are used primarily for short-term trades.

Steady Alert: This alert triggers when there are repeated opening sweeps in an option for a particular stock, and the price of the corresponding options contracts increase continually within a 60 minute time frame.

Swift Alert: This alert triggers when there are repeated opening sweeps in an option for a particular stock, and the price of the corresponding options contracts increase continually within a 5 minute time frame.

Large Alert: This alert triggers when a large contract exceeds open interest and is filled at the ask. This alert must also meet certain notional thresholds.

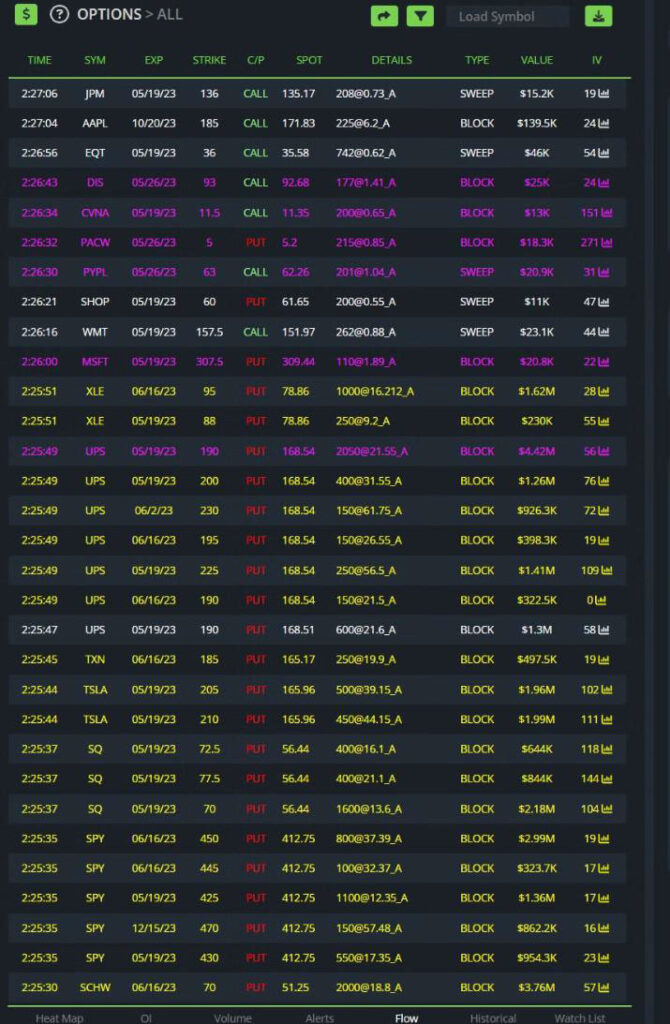

Options Flow / Historical Options Flow

Flow Tab

Options trades must meet our minimum contract size or notional value criteria to appear in the flow.

- Block or Sweep: Indicates a large block or sweep trade. Block trades are a single large trade executed at one exchange. Sweeps trades are large trades that are broken up and executed across multiple exchanges.

(We use our proprietary logic to determine sweep orders)

- White: Open Interest has not been exceeded.

- Yellow: Open Interest exceeded in a single trade: indicates a single block or sweep trade has exceeded the day’s open interest.

- Purple: Open Interest exceeded in multiple trades: indicates multiple block or sweep trades have exceeded the day’s open interest.